When loss rebates are offered as a strict rebate on total losses, without a time or play requirement, practically any game can be beaten. Roulette takes this theorem to the extreme, giving absurdly short average play times. This implies pure hit-and-run style play for the AP. For example, with a loss rebate of 15% on single-0 roulette, the AP will play, on average, about 11.7 hands before either leaving with a win or cashing out his rebate on a loss (see this post). This post presents a brief analysis of loss rebate advantage play on double-0 roulette.

To get the money down, the player has to make very large bets. In practice, the most money a player can wager in one round is by making a "complete bet." This bet is usually reserved for high rollers. With a $1000 inside-maximum straight up on any number, the player can make a complete bet of $40,000. For example, a complete bet on 17 is equivalent to the following wagers:

- $2,000 on 13, 15, 19, 21

- $4,000 on 14, 20

- $6,000 on 16, 18

- $12,000 on 17

If 17 hits, the player is paid $392,000. For the ordinary player, there are three types of stopping points:

- Win-exit: the player will stop playing after winning this amount.

- Loss-exit: the player will stop playing after losing this amount.

- Time bank: the player will stop playing after this amount of time.

In the case of the AP who seeks to beat loss rebates, there is no time bank restriction. The AP intends to continue playing until hitting either his win-exit-point or loss-exit-point. It follows that the analysis of loss rebate advantage play is equivalent to finding optimal stopping points that maximize the AP's average net-win for a given game, wager size and rebate percentage.

Side trip to nerd land ...

This problem can be viewed geometrically. Consider the surface in three dimensions, where for each point in the plane, (win-exit, loss-exit), the height of the surface is given by the net-win for the AP. Then, solving this problem is equivalent to finding the global maximum for this surface. Depending on the set-up, the problem of finding a global maximum can be solved in a number of different ways (derivatives, simplex, numerically, algebraically). Finding extrema is one of fundamental problems of mathematics.

Back when computers were first being programmed to play chess, some programmers tried to make their chess programs think like humans. The great chess grandmaster Capablanca once said, when asked how many moves ahead he looks, "Only one, but it's always the right one." Chess programs started to get really strong when programmers stopped trying to get their chess programs to "think" and instead took advantage of what computers do best: compute a lot of stuff really fast. The programs stopped trying to look for the right move, and instead looked at every move, and every move after that, and every move after that, with some pruning along the way.

I find the same holds for most gaming math problems. Back when Thorp showed that the "Natural 9" side bet could be beat, he did his analysis long hand. He published a bona fide research paper on the topic: "A Favorable Side Bet in Nevada Baccarat." (Journal of the American Statistical Association, Vol. 61, No. 314, pp. 313-328). Because Thorp didn't have access to powerful computers, he had to get his answers theoretically. Now, to solve a problem like this, I would do a little bit of combinatorial analysis to get a counting system, then run a simulation of a hundred million (or so) shoes to see how well it works.

For this loss rebate problem, here is an idea how I solved it by brute force computation. First, pick any reasonable starting point (x,y), where x = win-exit, y = loss-exit. Then compute the average net-win for the AP by simulating ten million (10,000,000) simulated AP's using those stopping points and averaging their results.

With this first simulation completed, run the same simulation for each of the 4 adjacent lattice points to (x,y):

- (x+$10000,y), (x-$10000,y)

- (x,y+$10000), (x, y-$10000)

If none of those lattice points gives a higher net-win, then the point (x,y) is the maximum. Otherwise, move to the lattice point that gives the highest net-win and do the same computation for its neighbors (this will be 3 more simulations). In this way, you are crawling up the slope of the surface and will eventually reach the maximum. It is possible that there is some sort of weird and unexpected shape going on here. To double-check, simply approach from several different directions (different random starting points) to check that you always get to the same top point.

Back from nerd land ...

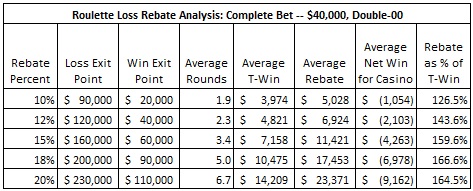

I will assume the AP wants to exploit double-0 roulette by making complete bets. I will assume the AP has a loss rebate equal to one of these values: 10%, 12%, 15%, 18% or 20%. The following table summarizes the win/loss-exit points and other statistics:

In the single-0 game with a 15% rebate, the AP will play an average of 11.7 rounds. For the double-0 game with a 15% rebate, the average number of rounds played is 3.4. With a 10% rebate, the AP will play less than 2 hands, on average. With a 20% rebate, the AP has an expected net-win of over $9,000 for less than 7 rounds (on average). At a normal game pace, this would be under 15 minutes of play. That's a great theoretical haul by the AP, but it is a practical game-protection absurdity.

As the numbers in this table show, there is simply no practical way of exploiting loss rebates on double-0 roulette in a brick-and-mortar casino.

[Note added 07.03.13]

I received an e-mail from an astute reader who stated:

Attached herewith the loss rebate simulations results for Double zero Roulette with complete bet. I found that my figures are similar to your results except the loss exit points, the difference is exactly the complete bet amount.

How excellent to have a reader do this work to check me! I need more of this. I am certainly capable of making big mistakes. In this case, the answer is one of definition, and it is my fault for being unclear.

I assumed the player came into the casino with an original bankroll BR. At any given point during his play, the amount he has at hand is Current BR. He makes wagers of size Wager Unit. The player continued to play until he either hit is win-exit point or else didn't have enough left in his bankroll to make another wager. That would be when (Current BR) < (Wager Unit). The question is, what is the actual loss exit point?

One can argue that the loss exit point is (BR) - (Wager Unit). This is the fixed boundary beyond which another wager cannot be made. This is the value the reader used when he double checked my work.

One can argue that the loss exit point is the average of the all the values (Current BR) when (Current BR) < (Wager Unit). These are the final bankrolls the player had at the time he quit. This would not give a fixed boundary that would be useful in practice.

Finally, one can argue that the loss exit point is the original BR. That is the physical amount the player brought to the casino, so it is his cash on hand that he plays from until he cannot play another hand. This is the method I used in reporting my results. That is, my loss-exit points are assumed to be the BR the player brought to the casino. I wrote my code in this fashion because the first version of the code was used to analyze Don Johnson, when I assumed he brought exactly 1M to the casino as his bankroll. I did not update the code to handle the more general loss-exit point given an unlimited bankroll.

It is clear that my method of reporting the BR differs from the reader's method of reporting (BR) - (Wager Unit) by exactly one Wager Unit. Issue solved.

This note applies to other loss-rebate posts where I give loss quit points.

I would like to extend my thanks and appreciation to the reader who brought this to my attention.