On the week in October that some were predicting the bubble on United States fantasy sports participation would burst because of a scandal suggesting collusion between the two largest sites in the industry, the exact opposite happened. DraftKings and FanDuel each had the largest weekends in each company’s history, with over $45 million in entry fees and almost $5 million in combined profits, respectively.

The world of fantasy sports, particularly football, has exploded over the last decade, creating millions of winners, losers and a legal system left wondering where the lines of skills competition versus sports betting should be drawn in an online world.

BIGGER THAN YOU THINK

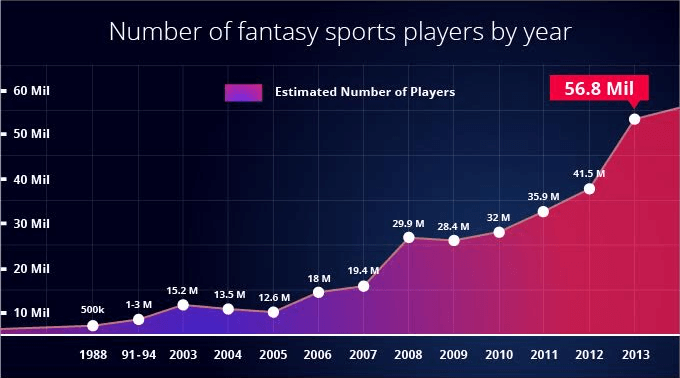

According to the Fantasy Sports Trade Association (FSTA), the numbers are staggering. While the number of players in the United States and Canada had been growing steadily in the last dozen years (more than tripling from 15.2 million in 2003 to 56.8 million in 2010) the money side of things has really grown in just the last few years as online site have figured a legal way, for now, to get in on the action.

Source: FSTA

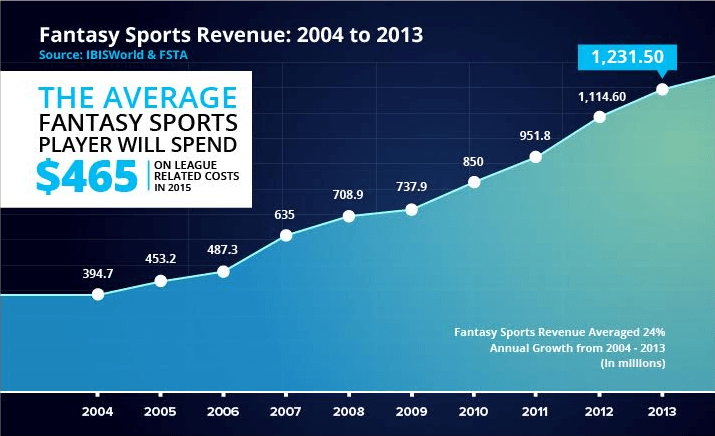

In 2012, the average fantasy sports user (of which there was about 36 million) was spending $80 per year, of which $60 (80 percent) went to cover the season entry fee. In 2015, the average fantasy sports user’s spending grew to $465 with more than 55 percent of that money going to daily - not seasonal - entry fees.

Source: TheAtlantic

Extrapolated, that means that in three years, fantasy online sports has grown from a $2.9 billion dollar industry in 2012 to one worth $26.4 billion in 2015. This makes online fantasy sports a larger industry in the United States and Canada than “Concert and Event Promotions,” according to analyst IBISWorld, which pegs that industry at $25 billion.

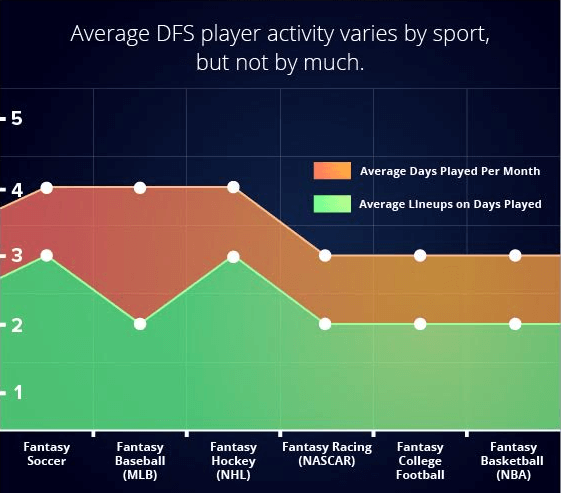

This switch in the industry to the more frequent participation of players and a proliferation of types of sports contested online has led the industry to use the terminology “Daily Fantasy Sports” (DFS) to describe the evolution.

While critics have suggested that fantasy sports games are nothing more than a virtual casino sportsbook, statistics from the FSTA reveal a well-educated, employed man as the average user. The average age of a fantasy sports player in 37, while 66 percent are men. Since football has been the specific sport that has really driven the fantasy sports industry, it’s not surprising that 73 percent of players report it as their favorite sport to follow and participate.

Source: Statista #1 & Statista #2

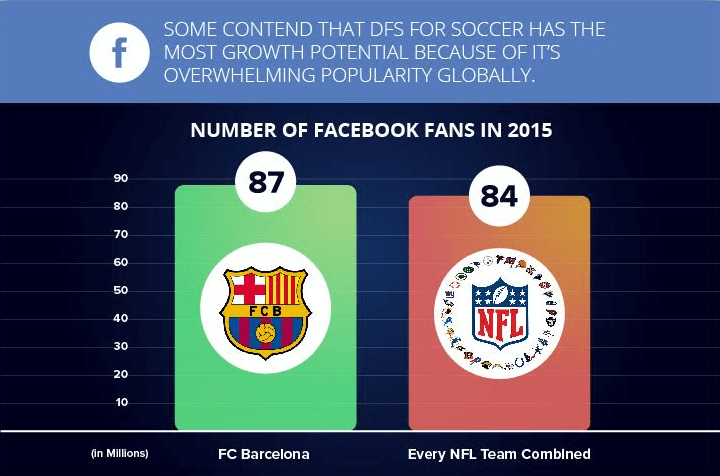

Fantasy football does make up the bulk of online DFS, but other major sports - including soccer - are starting to gain in popularity. In the traditional model, which still exists, a player pays a season entry fee, joins a league of other players and tries to put the best team together in a draft that takes place in the preseason. During that sport’s season, points are assigned for athlete achievements; at the end, the fantasy player who has consistently done the best receives a large percentage of the entry fees.

In the current DFS landscape, instead of season-long tabulations to determine a winner, a player can opt into competitions that last a week or a day. There are also a variety of ways payout occur, depending on the league and the specific contest. As an example, there are contests with tiered payouts, similar to poker tournaments. In “double-up” contests, players that finish with a point total that puts them in the top 50 percent of all participants win a prize that’s double the entry fee.

Data suggests that most players have both the mind and the means to participate in a variety of contests. FSTA found that roughly 57 percent of players have a college degree, 66 percent have full-time employment and 47 percent have a household income of over $75,000.

Source: FSTA

HOW WE GOT HERE

There are two ways to look at how DFS developed, each with merit.

The first would be that DFS is just the logical technological evolution of fantasy football, which can be traced back to the early 1960s when it was patterned after a fantasy golf game devised by then-owner of the Oakland Raiders, Bill Wickenbach. He, along with an Oakland Tribune columnist and another employee of the Raiders, devised fantasy football in 1962.

Wickenbach, several members of the Raiders staff and a few Tribune employees formed the first league of eight teams called The Greater Oakland Professional Pigskin Prognosticators League. The group held the now-familiar preseason draft and agreed on a points system, including 25 points for both field goals and touchdowns, 10 points for a successful extra point attempt and 200 points for a turnover or kickoff that resulted in a touchdown.

The concept caught on with others and within a few seasons, Oakland area bars that traditionally held events like trivia night to bring in customers were experimenting with fantasy football. Similar games for other sports, like Strat-O-Matic baseball, cropped up, but unless players were willing to put in the effort with pen-and-paper to track the stats, the world of fantasy sports was a small niche until the late 1990s.

With the advent of the Internet, nobody in your league needed to be a mathematician, since real-time stats could be updated live online. Both CBS Sports and Yahoo! Sports were early entries into the fantasy football market. At that time, it was free to sign-up and was treated more as an “extra” for the respective websites rather than the prime reason to visit the sites. As the educated prediction aspect of the game became popular, more sites developed fantasy football applications to capitalize on this growing interest.

The other side of the argument is that DFS sites are nothing more than modern day back-room gambling. When illegal wagering on sports was proliferating throughout Las Vegas in the middle of the 20th century, the way it was combatted - and largely wiped out - was to bring it into the legal gambling environment and regulate it.

Those who support this argument believe that when an individual’s money is put into a situation based on an outcome of an event they do not control, and the result of that event is either the loss or gain of money, it has become gambling.

Most DFS players do not regularly visits casinos, nor place bets in sports books, according to data on the subject. The average DFS player is more likely to drop $20 on an informal March Madness college basketball pool than they are to place a wager on a football team to win in a casino environment.

While it’s hard to deny the historical connection to traditional brick-and-mortar casino sports books, the FTSA cites the enormity of free options for participating and claims DFS players are in it for the competition, not the money.

“Fantasy sports players are motivated to enter the hobby for reasons that have nothing to do with money or prizes,” says the FTSA website. “The vast majority of fantasy sports players participate in free contests that have no cash or material prizes (over 74 percent of the 30.6 million fantasy sports players in 2010 entered a contest or used league software that included no cash or material prize, according to an IPSOS research report). The only enjoyment is winning and competing against other sports fans. In fact, frequent surveys of fantasy sports players show that the top reasons for playing include ‘competing with friends,’ ‘enhance my sports experience,’ and ‘to be in a league with friends.’”

It’s an interesting argument to make, since the two companies the FTSA represents - FanDuel and DraftKings - both highlight massive money winners and push the opportunity to earn money in their advertising. FanDuel’s advertising campaign has prominently featured the statement, “Paying out more $75 million a week! More than any other site!” The DraftKings advertising side of things is a little less blatant, although both companies’ websites highlight the ability to win money high on their homepage, with the first three lines of DraftKings’ website all emphasizing that money can be won.

THE ELEPHANT IN THE ROOM

So with millions of dollars being wagered on DFS, how is this industry not just simply the online evolution of gambling on games? It’s a question that state attorneys general are beginning to look at - and one that industry organization, such as FSTA, are virulently defending, saying that it’s a game of skill, not blind luck.

The FSTA’s website defends DFS as skilled-based, saying: “Managers must take into account a myriad of statistics, facts and game theory in order to be competitive. There are thousands of websites, magazines and other such publications that seek to synthesize the vast amounts of available fantasy sports information to keep their readers informed and competitive. A manager must know more than simple depth charts and statistics to win; they also must to take into account injuries, coaching styles, weather patterns, prospects, home and away statistics, and many other pieces of information in order to be a successful fantasy sports manager.”

The website continues: “The highest levels of competition within fantasy sports (for example, the National Fantasy Baseball Championship) routinely see top players win games more frequently than if the contests were random or highly based on chance. It’s a pattern that has been repeated with many fantasy sports contests and competitions: the highly skilled fantasy player wins more frequently.”

It’s not an invalid argument, and FSTA and other industry leaders point to the government carving out language in the Unlawful Internet Gambling Enforcement Act of 2006 - which targeted online casinos, specifically poker rooms, by making it illegal to transfer money from an individual’s bank account to an online casino. The language of the law did clarify a few activities that were not considered online gambling, specifically horse racing and fantasy sports.

DFS defenders point to specific language in the Unlawful Internet Gambling Enforcement Act of 2006: “...an outcome that reflects the relative knowledge of the participants, or their skill at physical reaction or physical manipulation (but not chance), and, in the case of a fantasy or simulation sports game, has an outcome that is determined predominantly by accumulated statistical results of sporting events, including any non-participant’s individual performances in such sporting events…”

In 2006, FSTA estimates 18 million people were participating in fantasy sports (almost exclusively football at that point) online, with most simply playing a fee of $50 or less to participate in a season. While that did make the industry one that ran into the hundreds of millions of dollars for revenue, it was a small percentage compared to online poker at the time, which was estimated to be $2.4 billion in 2005 (just before the government cracked down on it). That’s less than 10 percent of the revenue of DFS in 2015, despite its growth.

DOES ONLINE WAGERING HURT THE REAL THING?

Pressure to create the Unlawful Internet Gambling Enforcement Act of 2006 came from various sources, including traditional brick-and-mortar casino owners, financial institutions and watchdog groups worried about everything from underage gambling to the moral erosion of America.

Gaming industry executives worried that people would rather sit in the comfort of their own homes than get out to casinos with the explosion of poker and if history is any example, it’s a good model to look at for what may happen with DFS.

According to the University of Nevada Las Vegas Center for Gaming Research, which keeps among the best records of casinos in the United States, it’s not clear if the gaming industry really had anything to worry about when it came to poker. Between 2002 and 2006, when the explosion of Texas Hold'em happened - thanks to ESPN broadcasting the World Series of Poker and the availability of online poker - was taking place, Las Vegas also saw a small boost. After the online ban, they witnessed an explosion.

Las Vegas was actually in a poker slump when the resurgence occurred. In 1994, there were 93 poker rooms in Las Vegas featuring 586 tables. Those numbers had dropped to 68 rooms with 473 tables by the year 2000, and poker was, in fact, witnessing its worst year since statistics had been kept when, in 2002, there were only 57 poker rooms with 386 tables.

During the 2002-2006 poker rebirth, numbers crept up, with 96 rooms and 781 tables in 2005, the last year of online availability. Las Vegas saw the pop to 106 rooms and 886 tables in 2006. However, after online opportunities were shut down, poker saw unprecedented growth in Las Vegas. Between 2007 and 2010, Las Vegas averaged 112 rooms with 915 tables; what was an overall $57 million game for local casinos in 2002 grew to be worth $167 million in 2007.

The clear takeaway? It was outside the brick and mortar casinos that a new audience of poker players were born. Once their online options ceased to exist, a significant segment of the players migrated to casinos.

“There is a clear rise in brick and mortar poker revenue as online play increased,” said UNLV Center for Gaming Research Director Dr. David G. Schwartz.

Of course, get beyond statistics for 2010 and you begin to see the longer term impact of poker declining in Las Vegas, making that clear takeaway not so clear. By 2012, averages were down to 99 rooms with 809 tables were taking in overall revenue of $123 million. And despite revenue unchanging in 2013 (the last year data is available), available poker rooms dropped to 88 featuring 774 tables.

“Since brick-and-mortar casino poker revenues have declined since (the initial poker explosion), it may have hurt them. There are other factors as well though such as recession and cyclicality,” said Schwartz.

So about that clear takeaway: it seems there is no clear takeaway. Many more years of Las Vegas poker numbers will need to be collected to show if a short-term boom resulted in a long-term bust or if it just the economy and a game that runs in cycles.

That said, the story may be repeating itself with DFS online and Las Vegas sportsbooks.

According to statistics, in 2001 and 2002, as fantasy football was starting to gain steam online, Las Vegas sportsbooks averaged about $830 million in football wagers and almost $2 billion with all sports. By 2005, those numbers became $1.05 billion in football wagers and $2.25 billion total. Three years later, in 2008, things had grown to $1.12 billion and $2.57 billion. With the popularity of DFS growing, the numbers ballooned to $1.34 billion for football and $2.87 billion overall in 2011. And finally, the most recent statistics of 2014 show $1.75 billion wagered on football and $3.9 billion wagered overall - roughly double 2002’s average spend.

Schwartz argues that there could be a correlation between the rise in DFS and Las Vegas sportsbook revenues. “Possibly,” he said. “There has been an increase in the total sports betting win for casinos in the past five years.”

If DFS has had an impact that has resulted in Las Vegas doubling its sportsbook revenue in 15 years, why would they want to see it go away? If you look at the history of poker, it’s money. It took a few years, but once poker was banned online, casino revenues for the game tripled and stayed at all-time highs for a half-decade before receding to still-above average levels. With the exponentially higher interest and money in sportsbooks versus poker, if history is any indication, brick-and-mortar casinos could make an astronomical amount of money with a ban on DFS.

STATE GOVERNMENTS GET INVOLVED

While there has been an increased interest in redefining “games of chance” versus “games of skill” on a national level, the U.S. federal government is, at this time, leaving it up to the states to decide which category DFS falls into.

According to the website LegalSportsReport.com, neither FanDuel nor DraftKings does business in Arizona, Iowa, Louisiana, Montana, Nevada and Washington. FanDuel also has stopped accepting deposits from players in New York.

LegalSportsReport.com points out that the laws of the operation and the laws of participation are very different things in most states and that DraftKings, for example, has restricted these states based on laws or pending laws and may not reflect the current rules of a state.

If you think that’s convoluted, take a look at Nevada, home to Las Vegas, which is the only state in the U.S. that allows sportsbooks. Its gaming control board in mid-October ruled that DFS is the same as sportsbook gambling and would require a casino license. If FanDuel and DraftKings were to apply for that license, however, every other state where sportsbooks are illegal could use that as ammunition that those companies are promoting games of chance and not skill.

There are many state attorneys general looking into whether or not they have any power to ban wagering on DFS - and whether or not there’s an appetite for it. Among the states researching the issue now are Illinois, Pennsylvania and New York. Most are favoring the argument that was used when casinos proliferated across the United States over the last 20 years (40 states now have casinos) that it could turn into a public health problem because of the potential for addiction.

The FTSA defends its position that DFS is very different from sports betting by pointing out the vast majority of organizations that seem to approve of it.

“It’s hard to find organizations that are more sensitive to the issues of sports gambling than Major League Baseball and the National Football League. Both leagues support fantasy sports, help market fantasy sports to consumers and even operate and promote fantasy sports games, both free and pay-to-play, on their official web sites (MLB.com and NFL.com).” says the FTSA website.

“Similarly, all the major professional sports leagues support and often host their own fantasy sports leagues: NASCAR, NHL, PGA, NBA and many more. Almost all of the major media companies in the U.S., many of which are very sensitive to any association with sports gambling, support and promote fantasy sports: Yahoo!, ESPN, NBC, Sports Illustrated, CBS and many more.”

Other fantasy sports industry defenders cite the enormity of the “fantasy sports information” world as a reason the game should be considered skill and not luck. They reason that the amount of magazines, television programs, websites and mobile apps dedicated toward building a better team - but not having anything to do placing wagers - shows that money being changed based upon outcomes is just a small piece of DFS.

Detractors point to games, such as poker and blackjack, that many also consider games of skill, despite the fact the randomness of a deck cards would indicate it is a game of chance. If you look to these others games, despite the fact they are currently regulated as gambling, is there a clear answer?

Is statistically knowing what to do with a pocket pair in blackjack the same as statistically knowing how a quarterback does and where he should fit in your fantasy team? The best blackjack players still bust and that quarterback may throw his shoulder out in practice.

“Yes, blackjack is a game in which skill can give a player a positive expected value,” said Schwartz. He adds that he does think it’s a matter of semantics. While the UNLV Center for Gaming Research does not currently track DFS sports, it’s something Schwartz would like to do if he could find reliable resources. United Kingdom-based SuperLobby agrees with Schwartz, calling the debate a “high-stakes game of semantics” on its website. SuperLobby supports regulations similar to those currently in place in Massachusetts, which require DFS operators to promote responsible participation among players.

With an industry growing as large and quickly as DFS has, it’s not surprising the government seems slow to respond. But regardless of which side of the “skill versus chance” debate one falls on, its safe to assume that 2016 will lend a lot of clarity to the future of daily fantasy sports online.

How do you think fantasy sports betting should be regulated? We’d love to hear your opinion. Share it by leaving a comment below: